CCS Weekly Market Report

This week:

Gas and power prices rose on the back of elevated carbon prices, increased Ukrainian energy infrastructure concerns and large-scale future LNG projects in America being delayed

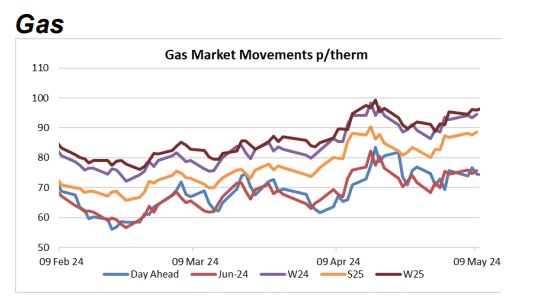

Gas

- Nationwide demand dropped again this week with the rising increased temperatures, peaking on Sunday

- European storage increased to almost 63%. Countries were able to inject more gas with the warmer temperatures

- Norwegian flows to the U.K. have maintained at lower levels this week as the summer plant maintenance work continues

- U.K. gas storage withdrawals and LNG send out increased to balance the U.K. gas system due to the Norwegian reductions

- Russia continued to attack Ukrainian energy infrastructure, hitting a thermal power plant. Ukraine struck a major oil refinery in Russia, 1,500km away

- Large scale Golden Pass LNG project in Texas risks delays due to a shortage of specialised workers, expected to be pushed back to the second half of 2025, weighing upwards on prices

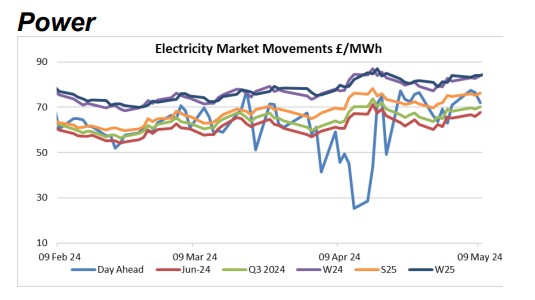

Power

- Overall, power demand fell week on week and is well below 2023 levels

- Wind generation reduced by 70% compared to last week

- Demand for gas to burn through power stations increased due to the low wind generation

- Solar generation has increased again by a small amount, expected to increase as we approach sunnier months

- Electricity from other countries to the U.K. through interconnector imports reduced this week, with a large reduction at the Viking Link from Denmark

- The increase in carbon price has continued to upwardly influence power and gas prices throughout the week

Wider Commodities

|

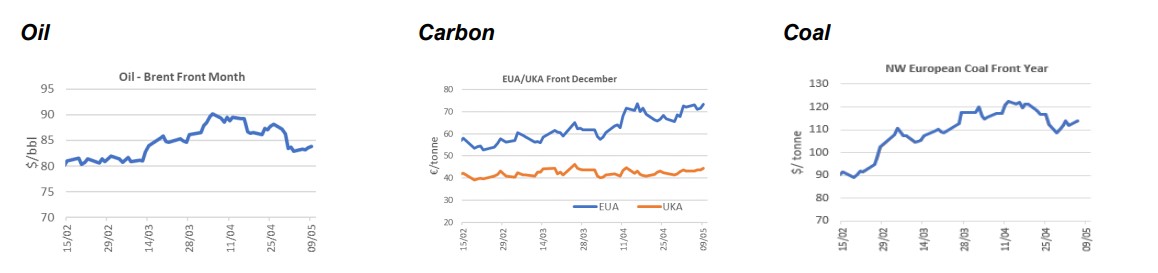

Oil traded sideways this week. There were mixed market factors happening including the ongoing Middle-East geopolitical conflict tensions with Israel rejecting the ceasefire proposal terms and taking military control of the Gaza side Rafah crossing. Rising Chinese imports and a decrease in U.S. crude stockpiles show potential signs of increased demand from the largest two oil consuming nations. Demand for jet fuel and diesel is increasing as the appetite for travel post-covid increases. |

Carbon has traded strongly upwards again this week. Low wind generation and a couple of days without auctions factoring in. The commitment of traders report shows institutions (pension funds and hedge funds) have cut their net short positions in carbon to a 6-month low and hold the largest net long positions in 2 years. Potential for more freely increasing carbon prices, with technical price now testing €75 and lower liquidity. UKAs have tracked EU carbon more closely this week. |

The price of coal is down slightly. The G7 agreed to close coal-fired power plants by 2035 with the ability to remain open with carbon capture technology. China overtook Japan in April as Australia’s top coal market importer. Asian thermal bids for coal rose slightly with higher summer demand in China, India and other parts of Asia. The warmer temperatures currently being experienced increase the requirements for air conditioning cooling. Russia removing their coal export tariff from May to August is also helping to soften prices. |