Paying bills takes time and time costs money. A Direct Debit saves you both by:

- Reducing your workload through less admin with no cheques to write and no posting

- Avoiding late payment interest charges because your bills are always paid on time.

When you pay by Direct Debit, you are protected by a money back guarantee from the bank in the event of any errors.

Alternatively contact us for advice on 0845 300 4904(1) or complete our form and we’ll call you back.

Did you know ...

Paying one bill is estimated to cost organisations between £20 and £50 in administration time. Multiply that by the number of bills you process and it adds up to a lot of cash. Direct Debit is the efficient cost effective alternative.

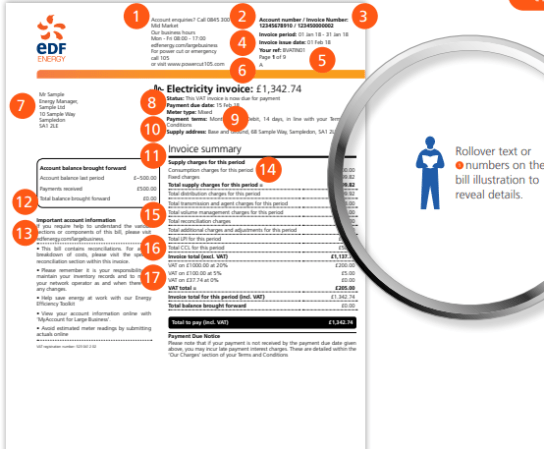

Understanding your bills

Understanding your bill

Understanding what makes up your bill helps to manage your consumption and could help cut your energy costs.

There are two sections to your bill:

If you have a specific query about your bill, please call 0845 300 4904.

What does “Price Point” mean, and how do I choose the right one?

Your Price Point is where on the electricity network your billing rates apply, this affects how your charges are calculated.

Note: If you have a Non-Half Hourly MPAN, your Price Point can only be Fully Inclusive (CT).

What are the different Price Point options?

Here’s a breakdown of the main options:

- Fully Inclusive (CT) - A fully inclusive priced contract, all your Transmission (TNUoS) and Distribution (DUoS) costs are bundled into your unit rate (p/kWh), based on the usage you confirmed at the time of pricing.

- Fully Inclusive (CT) minus DUoS - Here, only the DUoS charges are passed through. You’ll see them itemised on your invoice, based on your actual usage.

- Fully Inclusive (CT) minus DUoS and TNUoS - This is a full pass-through setup. Your unit rate won’t include DUoS or TNUoS instead, they’ll appear as separate charges on your invoice, based on what you actually use.

- Grid Supply Point (GSP) - This is also a full pass-through option, just like the one above, but with an extra detail: you’ll also pass through D-Losses (distribution losses). Your invoice will show two consumption volumes to reflect this.

Please note - regardless of your Price Point, you'll receive a yearly reconciliation for your Non-Electricity Charges.

You can choose to receive your bills in your preferred format. Either:

- paper bills

- electronic files

- pdf invoices

Electronic files are sent in MM format and can be uploaded directly into your validation systems. Or you can view them on our free e-bill reader software, which configures the data into a readable excel format and provides you with a variety of reports to view the data. You can order eBilling through MyBusiness.

Paying the right amount of Value Added Tax (VAT) is fundamental for any business. You may be eligible for the reduced rate of VAT if you meet certain criteria.

VAT will normally be charged at the standard rate if the energy you use is solely for business or non-domestic purposes. VAT, which is also applied to Climate Change Levy, will be added to your bill.

A reduced VAT rate is available through a government concession for ‘low usage’ of electricity and gas. Where applicable, the reduction is applied automatically to your bill. The current low usage thresholds are:

- Electricity - at or below 33 kWh per day during the bill period

- Gas - at or below 145 kWh per day during the bill period.

If use is wholly or partly for domestic or charitable non-business purposes, that part of the supply qualifies for the reduction. This is known as ‘qualifying use’. You will need to complete a VAT Certificate of Declaration (for each account) advising us of the qualifying use.

Where there is 60% or more qualifying use (either domestic or charitable non-business), the whole of the supply is chargeable at the reduced rate of VAT. Your VAT Certificate of Declaration should, however, reflect your best estimate of the actual percentage of qualifying use. As per HM Revenue and Customs (HMRC) guidelines.

Learn more about the government’s VAT guidelines.