CCS Weekly Energy Market Report

Energy Market Update: Week ending 27th June 2025

Prices continue to be volatile on Israel-Iran tensions, but are calming down as the ceasefire holds.

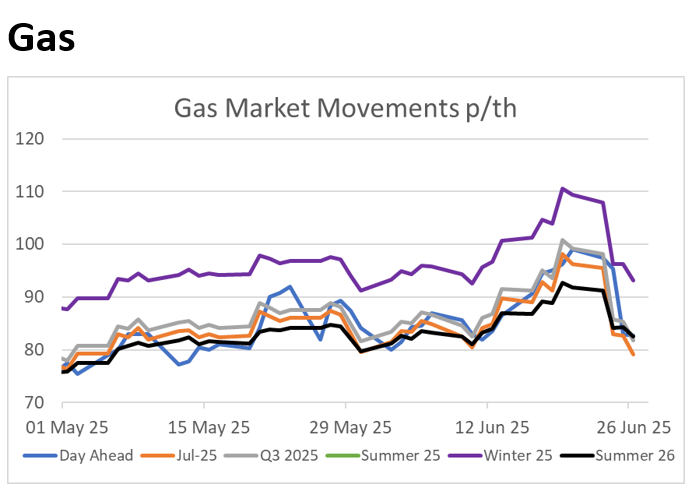

Gas Market Update

- E.U. gas stocks increased from 55.4% to 57.15%

- Expectations are that 90% gas storage could be reached by the end of the summer now

- Prices continued to rise on Israel-Iran war developments before falling following the ceasefire which seems to be holding

- Israel reopened its Leviathan gas field, sending surplus gas to Egypt

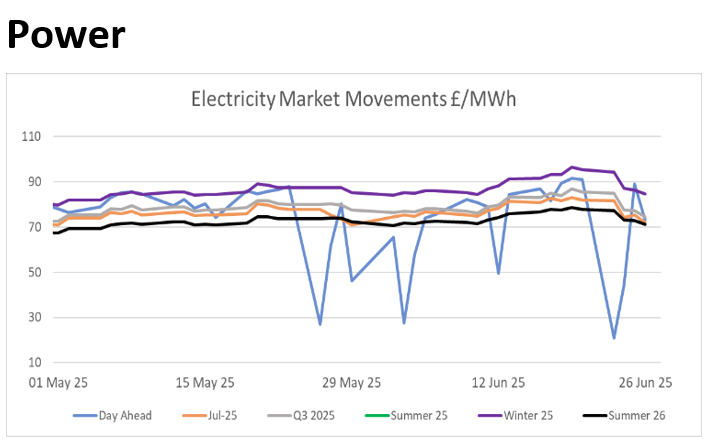

Power Market Update

- Power prices are also calming on Iran-Israel ceasefire

- EDF have outlined there is a possibility of reduced French nuclear output because of the developing heatwave in France which may mean some units are curtailed

- There were reports that the UK government are likely to reject zonal pricing proposals according to Bloomberg

Wider Commodities Update (Oil, Carbon, Coal)

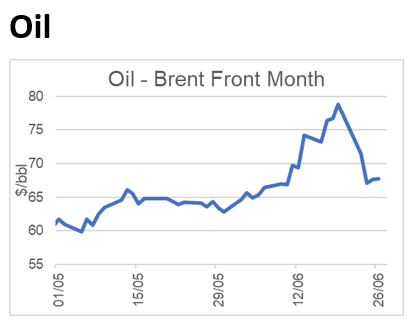

Oil

Oil prices fell to a two-week low as the Iran-Israel ceasefire holds, reaching levels similar to those before the recent escalation. The UK sanctioned 20 Russia-linked oil tankers. The flow of vessels going through the Strait of Hormuz has increased and are steady, despite Iran's attack on a US military base in Qatar.

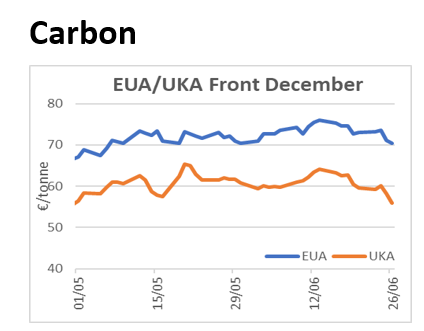

Carbon

EUA prices dropped by 3.9% last week, the largest loss in two months, driven by technical selling and options hedging ahead of June's expiry. UKAs also moved downward, widening the discount to EUAs to ~€14/tonne.

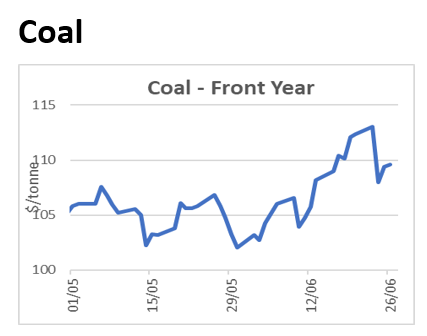

Coal

Asian metallurgical coal prices continued their downward price trend due to subdued demand. India’s metallurgical coke import quota faces uncertainty, monsoons are keeping demand weak.