CCS Weekly Market Report

This week:

Both gas and power prices made strong gains through the couple of days of the week but on Wednesday prices retraced and moved lower. Prices did see some recovery yesterday but majority of seasonal contracts remain at lower levels than last week

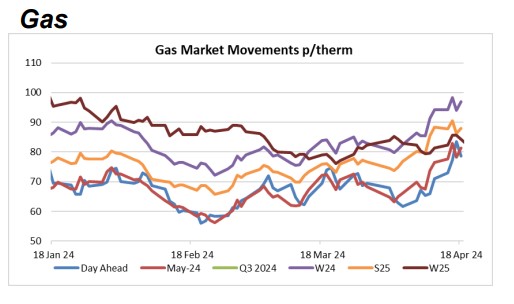

Gas

- Gas demand has remained below seasonal normal this week but we have seen an increase in domestic demand due to the lower temperatures this week

- European storage now at 62%, all major EU countries are continuing with net injections

- Norwegian flows dropped this week due to an unplanned at one of their processing plants. The UK took the brunt of the drop but the issue was quickly resolved and flows recovered quickly back to normal levels yesterday

- LNG send outs and storage withdrawals both stepped up this week in order to fill the gap of lower Norwegian gas flows

- Gas has continued to remain closely linked to the Carbon and has closely followed it’s movements again this week

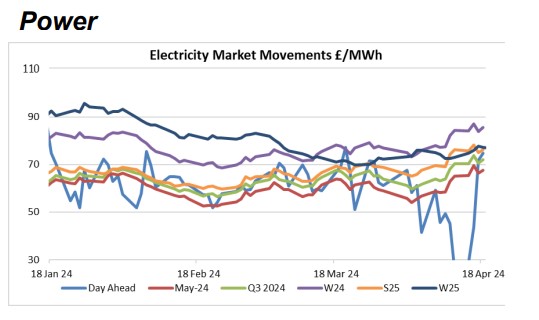

Power

- Overall power demand is largely in line with last week

- Wind generation has decreased slightly this week but we are still seeing much higher levels than seasonal normal

- We have seen power sector gas demand step up a touch this week but relatively speaking gas fired power demand has remained subdued. We have seen interconnector imports step up this week which has helped to reduce gas demand in light of the above mentioned lower Norwegian gas flows

- Prices have been volatile this week across the curve with power prices taking direction from the gas and carbon prices. Carbon continues to lead he way in terms of power movements.

Wider Commodities

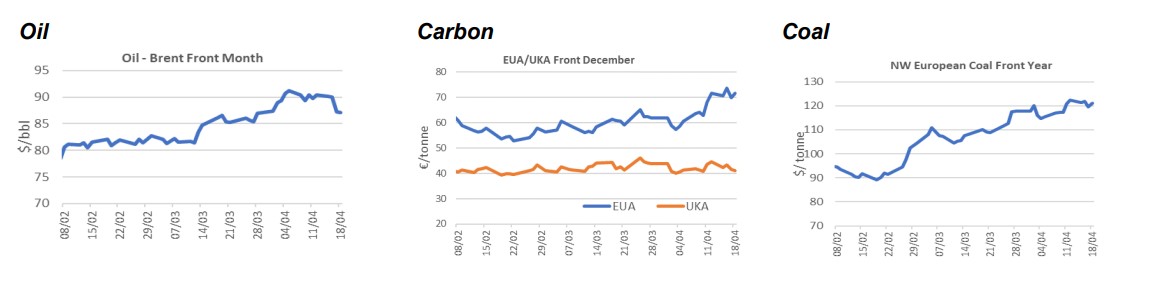

| Brent has moved lower this week and yesterday managed to break below $86/barrel. Oil prices appear to be unfazed by the Iranian attacks on Israel and throughout the week prices feel further as Geopolitical risk diminished. Some traders are suggesting that Oil is already carrying a pretty hefty price risk premium associated with the middle eastern conflict. US crude socks increased again this week adding further bearish pressure and the US also reimposed sanctions on Iran and Venezuela this week |

Carbon has been volatile this week with EU prices rallying early in the week to reach €75 before retracing on Wednesday to below €70. Fundamentals for Carbon remain bearish and some polls this week suggest traders are anticipating a fall in Carbon prices during the second half of 2024. Speculative traders and technical continue to dominate the Carbon Markets at present |

Coal has been fairly rangebound this week with no big movements. Chinese demand has increased this week due to the rising temperatures in the country and there is an expectation of an increase for imports. Indian demand remains fairly stable as industrial demand remains subdued but temperatures have caused an increase in domestic demand. The Vietnamese Gov has also suggested that power demand over the next few months is likely to increase by ~13% |